#Climatechange, #Netzero, #Sustainability

Climate risk assessment tools are gaining prominence in financial institutions, helping to identify, measure, and manage climate risks affecting investments and operations. The implementation of advanced technologies like artificial intelligence is enhancing the precision and efficiency of these assessments, increasingly integrating into risk management systems. Greater transparency and standardization in climate reporting are emphasized to comply with global regulations.

Financial institutions face growing regulatory pressure to meet standards like TCFD recommendations and ISSB requirements. The evolution of these regulations demands detailed insights on managing climate risks and opportunities, driving the adoption of sustainable strategies and facilitating the transition to a low-carbon economy. Integrating these practices has become a strategic priority for many entities.

Significant challenges remain, including the lack of uniform data and the complexity of risk assessment models. Existing tools still struggle to provide comprehensive coverage of climate risks, particularly in emerging markets and unlisted sectors. Overcoming these barriers requires closer collaboration between financial institutions, tool developers, and regulators to develop robust solutions tailored to global market needs. Here you can find the link to view the document.

Here is the link to access the document: https://bit.ly/4gYkc15

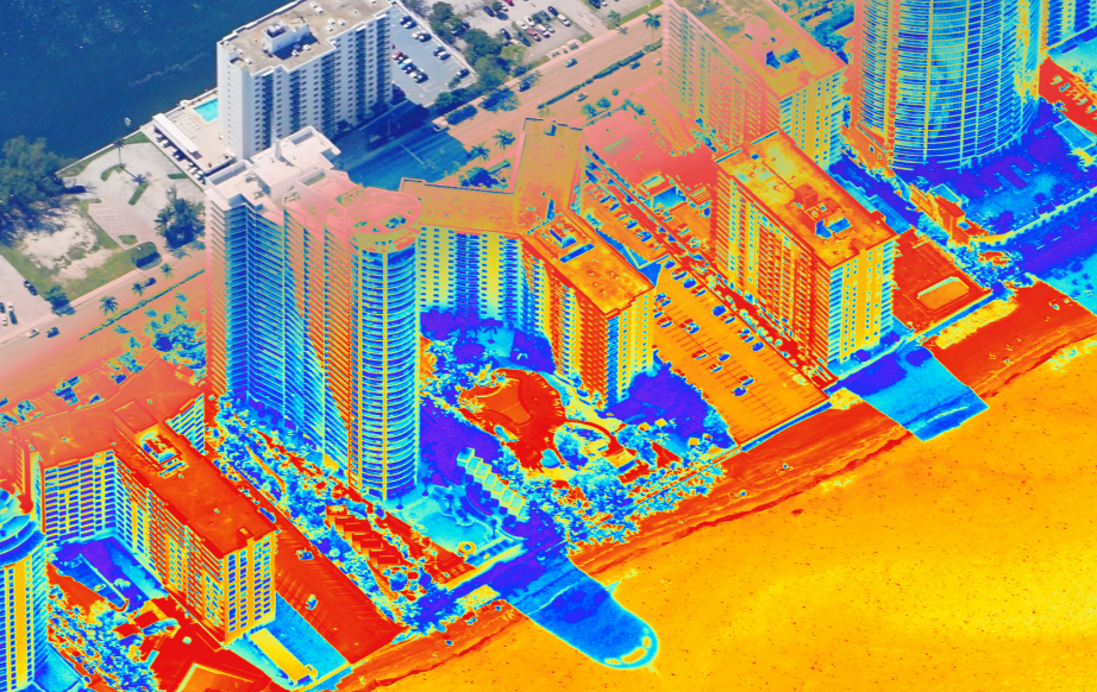

Climate-risk analytics help real estate professionals manage physical risks like extreme weather and sea-level rise.

Accessibility Tools